Plasma XPL Public Sale: Behind the Data

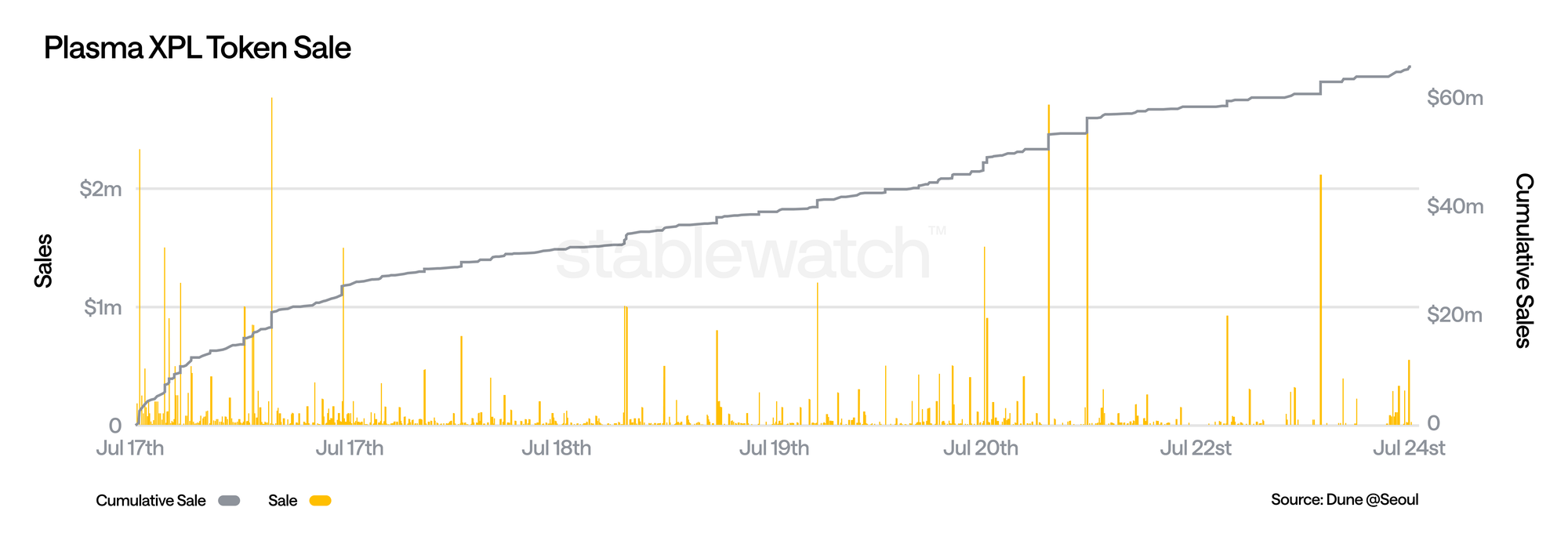

The Plasma XPL public sale, launched on 17th and set to end on the 28th of July, has been a resounding success, so far raising $66,237,736 in cumulative sales across 2195 unique addresses, with an average investment of $30,177 per participant. The sale allocates 1 billion XPL tokens (10% of total supply) at a $500 million fully diluted valuation.

A comprehensive transaction analysis revealed the temporal distribution of participation, with front-loaded momentum typical of high-demand launches:

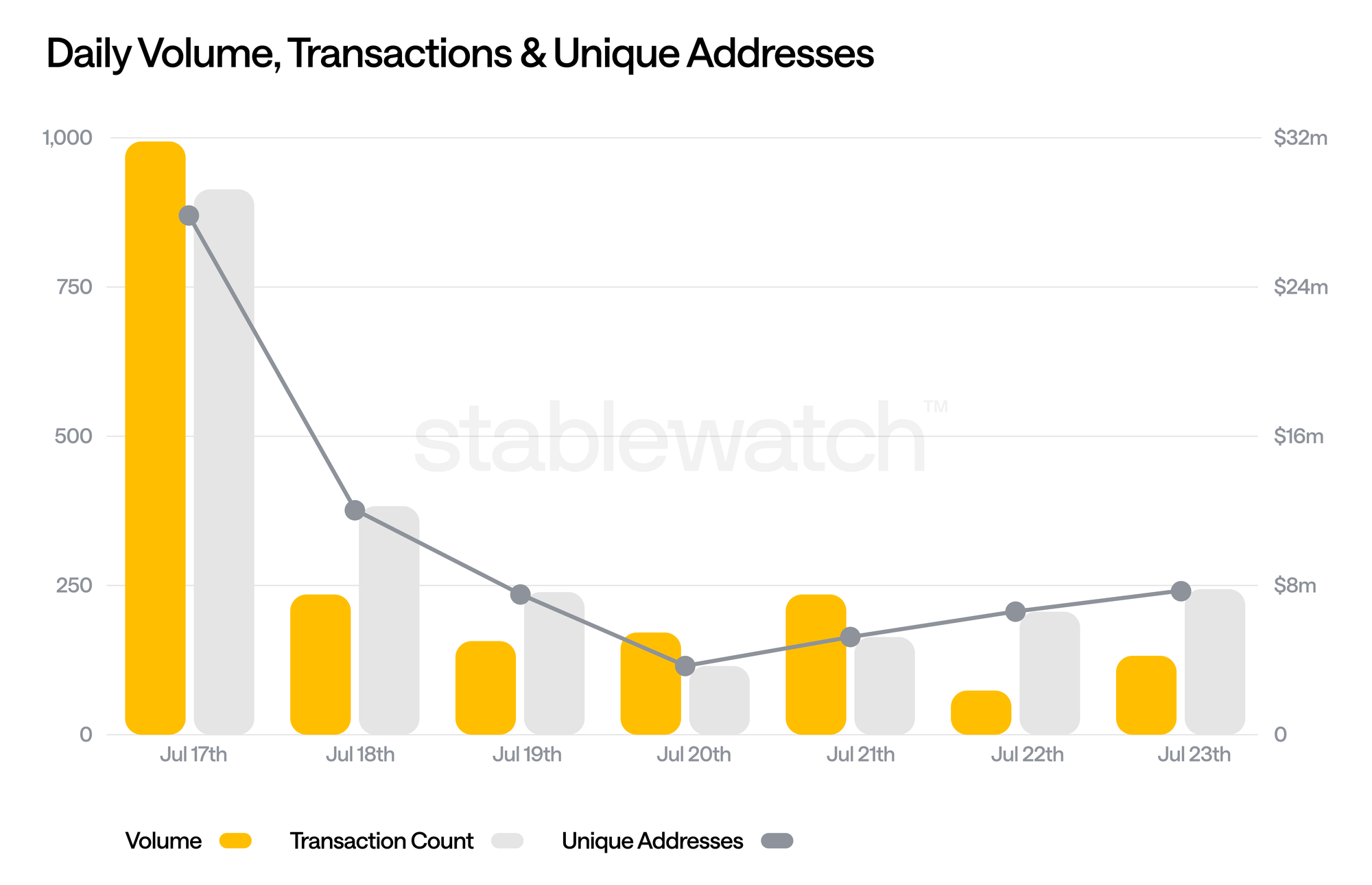

Daily Transaction Breakdown (July 17-23):

- July 17: $31.71M (48.0%) - 915 transactions, 867 addresses

- July 18: $7.56M (11.4%) - 381 transactions, 375 addresses

- July 19: $5.04M (7.6%) - 239 transactions, 234 addresses

- July 20: $5.53M (8.4%) - 117 transactions, 113 addresses

- July 21: $7.57M (11.5%) - 165 transactions, 163 addresses

- July 22: $2.46M (3.7%) - 207 transactions, 205 addresses

- July 23: $4.29M (6.5%) - 243 transactions, 242 addresses

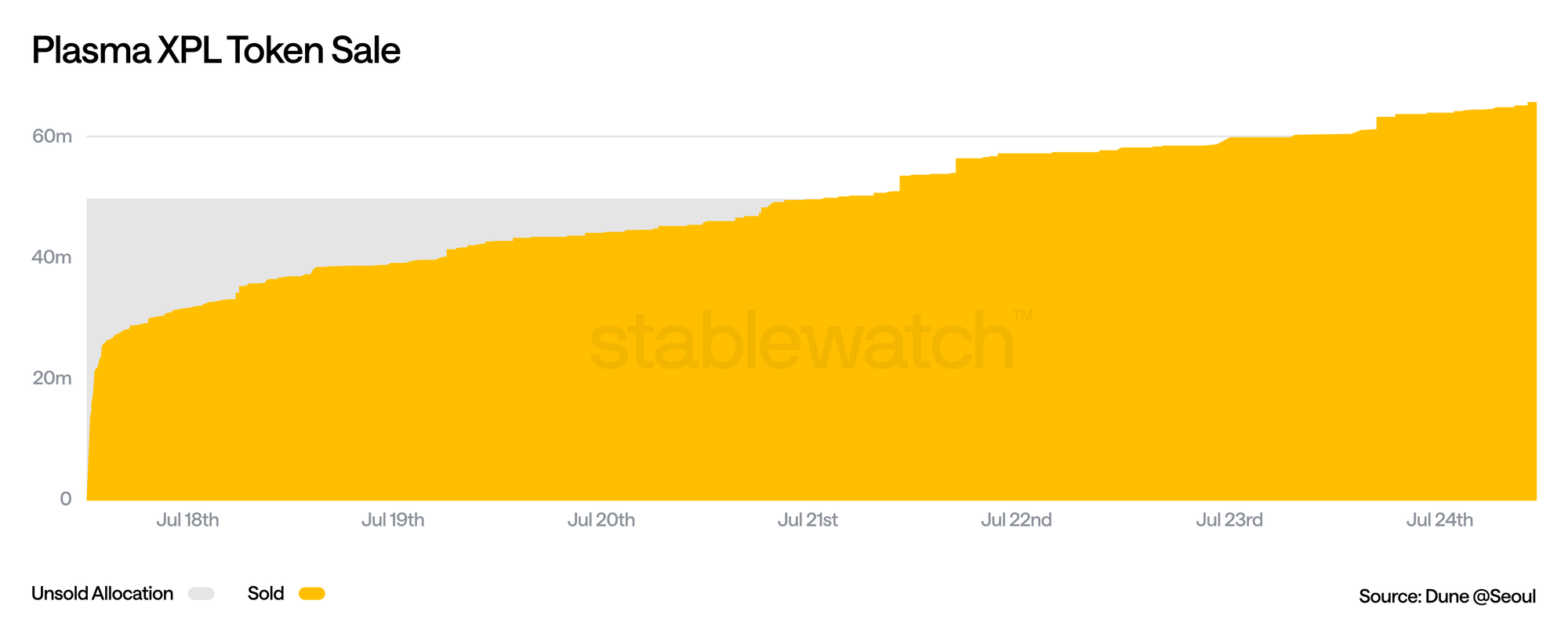

The allocation progression demonstrates steady token distribution across the sale period, with the sale exceeding the allocation of XPL on July 21st. The sale is currently 132% oversubscribed, with it projected to be 188.90% oversubscribed by the end of the public sale.

Transaction-level analysis reveals a diverse investment profile spanning retail to sophisticated investor participants:

Investment Size Segmentation:

- Retail ($0-$1k): 604 transactions (35.9%)

- Small Investors ($1k-$10k): 612 transactions (36.3%)

- Medium Investors ($10k-$100k): 364 transactions (21.6%)

- Large Investors ($100k-$500k): 87 transactions (5.2%)

- Whale Investors ($500k-$1M): 8 transactions (0.5%)

- Mega Whales ($1M+): 9 transactions (0.5%)

The largest individual transactions were $2,764,068, $2,337,001, and $1,500,000 respectively. Major names on CT were present in the sale with @0ctoshi and @Cbb0fe publicly mentioning their involvement. Other X profiles listed within the top 100 of depositors were @yes296no, @tummyy1 and @chud_eth.

My current portfolio 📊

— Octoshi.eth (@0ctoshi) July 22, 2025

I think it will be interesting to explain each of my positions 👇 pic.twitter.com/2k7UmXbOPs

Glad to announce that CBB cartel secured +$1.8M allocation in @PlasmaFDN public sale.

— CBB (kippah era) (@Cbb0fe) July 17, 2025

Trillions. pic.twitter.com/MHtaiPQqQv

Pre-Sale Deposit

Plasma opted for a multi-stage campaign in order to qualify for the public XPL sale that netted $1,000,034,365 in deposit commitments to the Plasma Chain from 2,930 addresses. This resulted in a 64.4% conversion (1,886 from 2,930) into purchased XPL.

The deposit accumulation timeline reveals the phased approach of the deposit campaign. The campaign initially launched on June 9th with a $250m cap on deposits and a $50m constriction on any single wallet. After this limit was astonishingly breached in less than a minute (time is not linear on the graph) there was an extension of the deposit cap by $250m, this amended cap was filled in 2 minutes. Subsequently on June 12th the deposit cap was extended by a further $500m. This was filled over the course of 35 minutes.

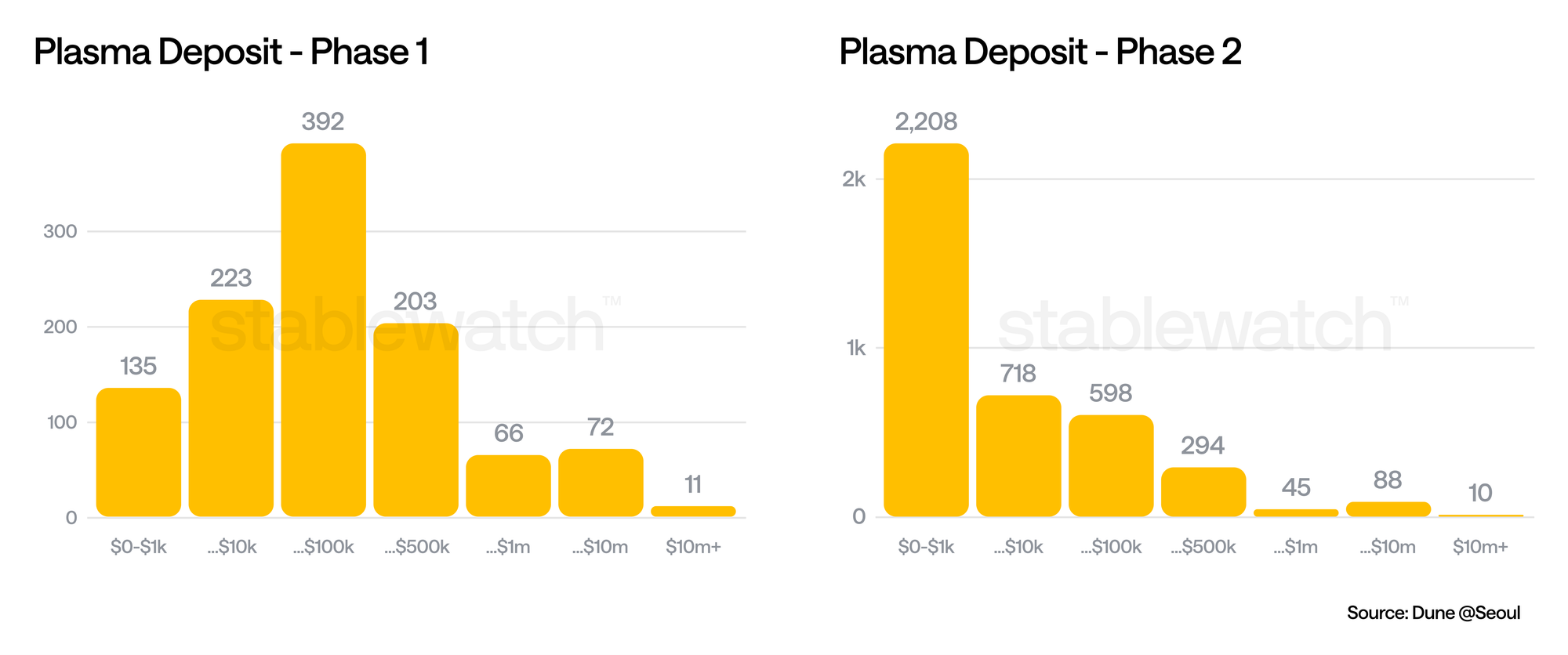

Phase 1 (June 9, 2025): Attracted $500,000,022 from 1,107 addresses with an average deposit of $451,671, showing heavy institutional and high-net-worth participation. The distribution peaked in the $10k-$100k range with 392 participants, indicating sizable sophisticated investor interest.

Phase 2 (June 12, 2025): Generated $500,034,343 from 1,944 addresses with a lower average of $257,219, demonstrating broader retail inclusion. The distribution shifted dramatically with 2,208 participants in the $0-$1k range, showing that Plasma was able to successfully extend the sale to retail participants.

The overall deposit participant distribution reveals balanced engagement across investment tiers: 496 participants in the $0-$1k range, 791 in $1k-$10k, 910 in $10k-$100k, 459 in $100k-$500k, 95 in $500k-$1M, 157 in $1M-$10M, and 22 participants exceeding $10 million. This distribution indicates genuine community participation while still securing major high ticket backers.

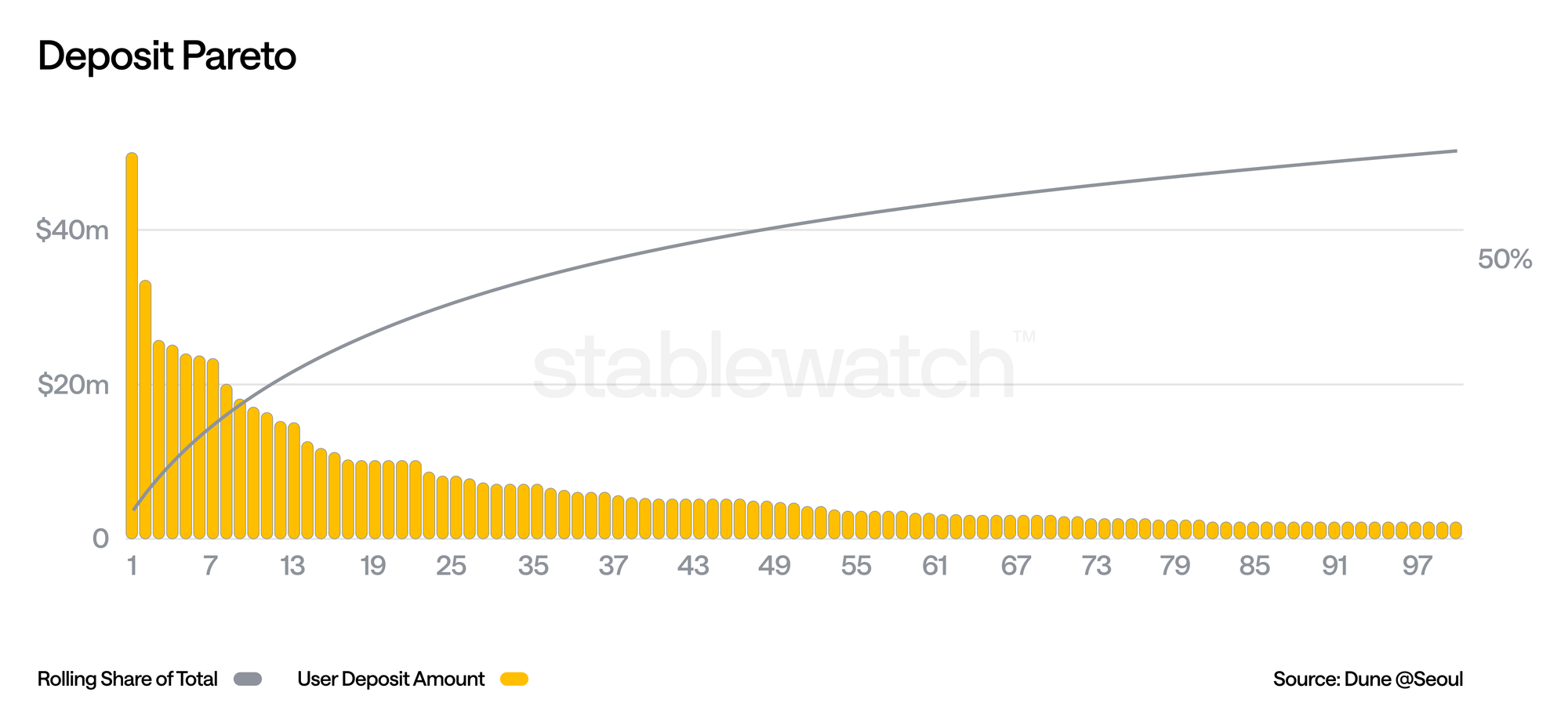

The deposit distribution exhibits the Pareto principle with top depositors controlling a significant percentage of allocation while broad-based participation is displayed across smaller investment amounts.

Stablecoin Preferences and Transaction Costs

USDC represented 58.4% of deposits and USDT at 39.6%, totaling 97% of all deposits. The remaining 3% was distributed between USDS and DAI.

The deposit process incurred $261,745 in cumulative transaction fees across 101.09 ETH in gas costs, representing approximately 0.026% of total deposit value. These operational costs demonstrate the expenses associated with Ethereum-based DeFi operations while remaining proportionally minimal.

Stage Progression

Stage 1 - Deposit Period: Generated over $1 billion in qualifying deposits facilitated by Sonar by Echo, in partnership with Veda protocol ($4.4B TVL) providing yield generation for deposits

Stage 2 - Lock-up Phase: Implemented 40-day minimum lockup preventing speculative behavior while standardising deposits to USDT.

Stage 3 - Public Sale Execution: Delivered $58.8 million in actual sales with 64.4% address conversion rate.

→ We are here

Stage 4 - Token Distribution: Pending mainnet beta launch will trigger distribution with bridged vault positions enabling native Plasma withdrawals.

Tokenomics

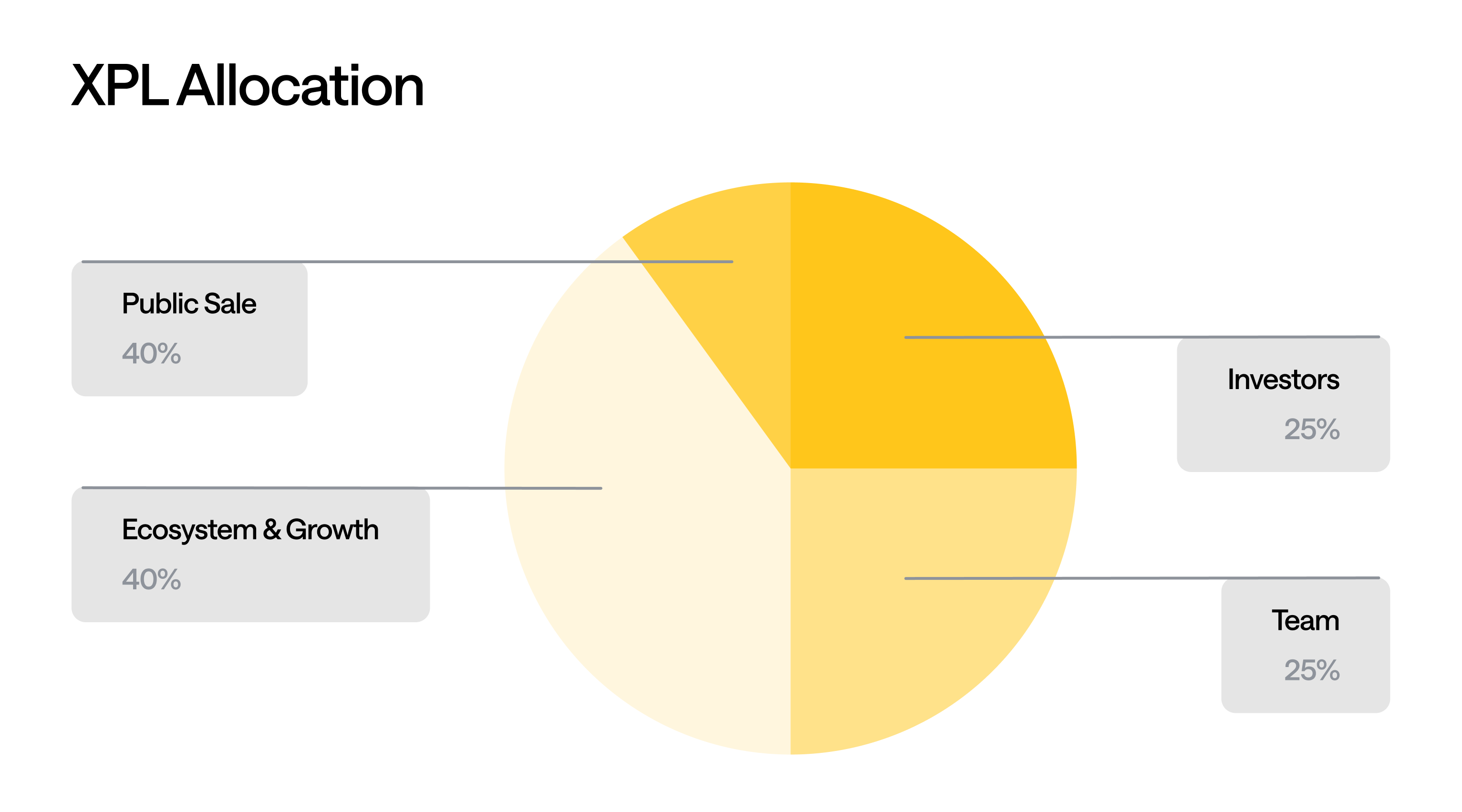

- Public Sale (10%): 1 billion XPL distributed through the current sale for broad community participation

- Ecosystem & Growth (40%): 4 billion XPL representing the largest allocation for network development, partnerships, and incentive programs

- Team (25%): 2.5 billion XPL with extended vesting schedules ensuring long-term alignment

- Investors (25%): 2.5 billion XPL with cliff periods preventing immediate sell pressure

Vesting Schedule

Public Sale Vesting:

- Non-US participants: Immediate unlock at mainnet beta launch

- US participants: 12-month lockup period ending July 28, 2026

Ecosystem Allocation:

- 8% (800 million XPL): Immediate unlock for launch activities

- 32% (3.2 billion XPL): Linear monthly unlock over 36 months

Team and Investor Vesting:

- One-third unlock after one-year cliff period

- Two-thirds linear unlock over subsequent 24 months

Core Utility

XPL serves multiple critical functions within the Plasma ecosystem as the native utility token for the blockchain's Proof-of-Stake consensus mechanism:

- Transaction Fees: Primary gas token for non-sponsored network transactions

- Staking Rewards: Validator participation with 5% initial inflation declining to 3%

- Delegation Rights: Token holder participation in network security through delegation

- Governance Power: Future voting capabilities on protocol upgrades and treasury allocation

This analysis is for informational purposes only and does not constitute investment advice.