Project Spotlight: Perena

The most prevalent issue within the stablecoin landscape is the fragmentation of liquidity. With new variants of tokenised USD seemingly launching daily, each version becomes significantly less valuable due to the increased cost of swaps and division of integrations. Enter Perena who aims to tackle these capital inefficiencies specifically on Solana by trying to create a unified liquidity layer for both DeFi native and institutional users of stablecoins. In addition to this, Perena seeks to make stablecoins more accessible for value storage, yield generation and liquidity provision through a single interface. Its long term goal is to establish a “Stablebanking” framework, where, as stated by the project, stablecoins become liquid, composable, and yield-aware financial primitives accessible to everyone, everywhere.

Perena is founded by Anna Yuan who previously served as the head of stablecoins at the Solana Foundation. The project is supported by notables in the Solana ecosystem including co-founders Anatoly Yakovenko and Raj Gokal and core contributors from the likes of Ethena Labs, Wormhole Foundation, Jito Labs, Squads, Ellipsis Labs,, Artemis, RWA.xyz,, Temporal, Cube, Decaf, Huma Finance,, Marinade, and Sphere. These connections not only provide technical and strategic support but also position Perena as a future central player in the Solana ecosystem. To support its vision Perena has raised a seed round from Binance Labs, Primitive Ventures, SevenX Ventures, and Maelstrom.

Product

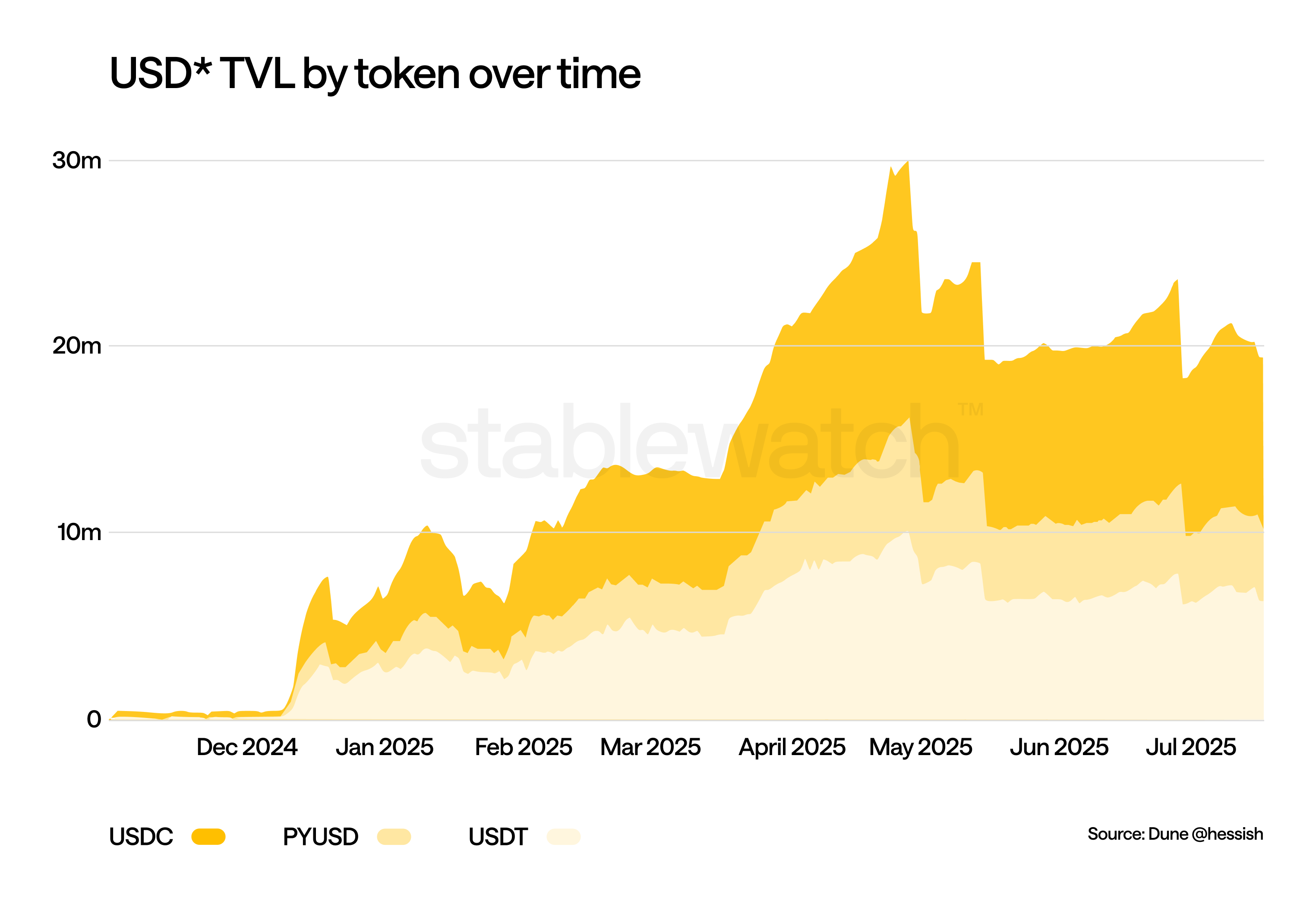

Their flagship product is Numéraire, a next-generation automated market maker (AMM) designed specifically for stablecoin trading. Unlike traditional AMMs, Numéraire utilises a hub and spoke model with USD* (pronounced USD Star) acting as the central hub asset. Instead of facilitating direct swaps they route funds through USD* in two subsequent parts (e.g. USDC to USD* to USDT), thereby according to Perena optimising liquidity and reducing trading fees. According to Perena, Numéraire would reduce high startup costs and inefficiencies associated with launching a new stablecoin. USD* aims to be a utility driven token unifying liquidity for all its underlying stablecoin variants and is currently backed by a diversified basket of USDT, USDC and PYUSD. Leveraging Solana’s capability USD* is trying to capture and provide real time yield distribution to holders generated by stablecoin swaps through Numéraire.

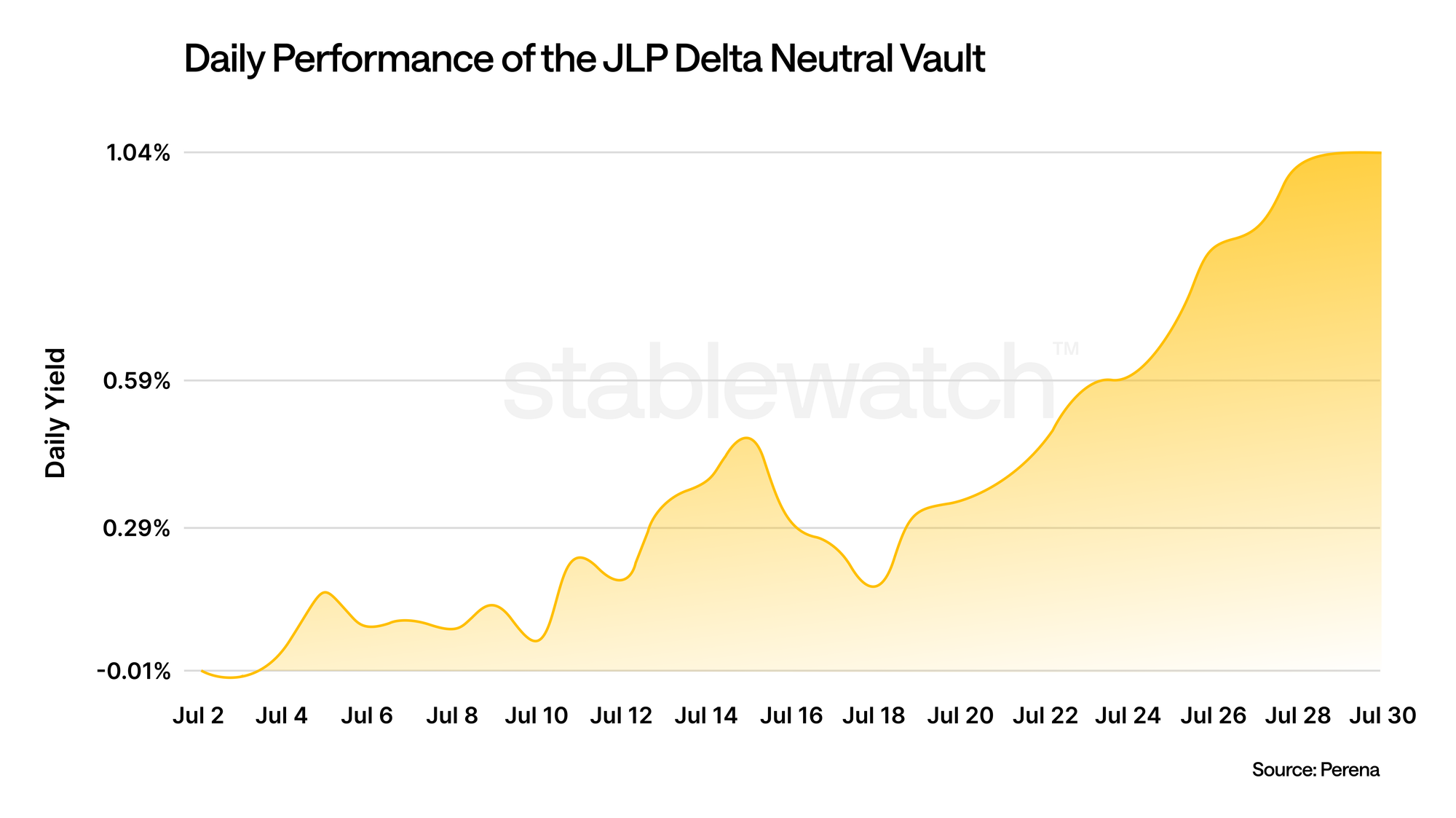

Perena also offers vaults which are designed to put the stable assets in the Perena ecosystem to productive use through automated, strategy-driven deployments. The first of these is JLP Delta Neutral which as of time of writing this article offers a yield of up to 11.45% APY (subject to changes). This strategy aims to earn trading fees, borrowing fees and liquidation fees from traders on the Jupiter’s perps DEX, while aiming to remove any directional exposure from holding JLP. The vault is administered by Neutral Trade and aimed to be monitored 24/7, dynamically leveraging based on predicted fees. The second vault which is yet to be released as of the time of writing this article and to also be administered by Neutral Trade, is called Hyper JLP Vault. It aims to earn yield by swapping WETH for HYPE, WBTC for cbBTC, and SOL for dSOL (earning an expected ~8% APY through liquid staking, Hyper JLP would be looking to deliver upside while placing idle stablecoins into delta-neutral strategies.

Delta neutral strategies are not risk free and the deposits are subjected to some losses.

The newest product announced by Perena in response to the GENIUS act being passed in the US, is the compliant stablecoin USD’ designed to meet new regulatory standards. USD' is fully collateralized and redeemable 1:1 for US dollars, backed by Franklin Templeton's BENJI tokenized money market fund ($1.4 trillion AUM) and Superstate's USTB fund. This new stablecoin would be issued through Brale, a US-licensed stablecoin platform. USD’ offers institutional-grade banking rails with ACH and bank transfer capabilities, plus 1:1 swapping with USDC and 20+ stablecoins across Solana, EVM, and Canton networks.

"Stablecoins are THE TOOL for the dollar to maintain its dominance globally.

— Perena (@Perena__) July 23, 2025

Perena is transitioning into a crossroad of permissioned, traditional and Defi to mimick the singleness of money with relatively clear regulation."

Anna Yuan, founder of Perena on @Blockworks_ pic.twitter.com/BdpvpxZd78

Legacy Models Comparison

Perena’s approach deviates from the traditional stablecoin AMM design which was popularised by Curve Finance, founded in 2020 by Michael Egorov. Curve utilises a bonding curve model within its StableSwap invariant, this is a hybrid approach of constant-product and constant-sum formulas specifically designed for assets with similar values. This enables Curve to maintain tight price stability and low slippage for trading assets like USDT and USDC.

Perena as mentioned prior innovates on this approach by unifying liquidity under the USD* stablecoin in order to allow trades for all backing assets to be facilitated through a single pool, with growth pools for an increased asset breadth. In addition to this Perena benefits from the cheaper fees on the Solana blockchain and provides additional tools such as the JLP vaults. This comprehensive solution provides an alternative to traditional swaps and additionally gives liquidity providers the option to maximise their yield (taking on additional risk) through productive delta neutral deployment of their deposited assets backing USD*.

Traction

Perena has achieved significant traction since its December 3rd 2024 launch with Numéraire reaching a TVL of $23.02m at the time of writing and having $1,981,193,435 Total swap volume and 3,066,615 swaps (as of 17th July). When compared to Curve however it shows that Perena still has meaningful room to grow. Curve at the time of writing has over $2.4B of deposits with a past 30 day DEX volume of $5.5B.

Perena’s USD* already has multiple integrations making it composable across the Solana ecosystem. This is in addition to the emergence of the Perena Stablebanking Network, which currently boasts 22 members. This would serve as a distributed system to unify stablecoin infrastructure, yield strategies, liquidity rails, and payments into a single architecture.

Looking Forward

Stablecoins technically should be a winner takes it all market, liquidity begets liquidity which begets market share. However in the current environment every major corporate and financial institution from Amazon, to Walmart to JP Morgan and other banking consortiums are intending to launch stablecoins. We will have a largely fractured market which will require projects like Perena to facilitate liquidity cohesion to increase efficiencies and allow the benefits of stablecoins to shine.